MSCI World vs S&P500 : What is the best ETF ?

8/31/2025

MSCI World vs S&P 500 ETFs: A Comprehensive Comparison for Beginners

Investing in a stock market index fund is a smart way for beginners to gain broad exposure to the market. Two of the most popular options are S&P 500 ETFs and MSCI World ETFs. The choice essentially comes down to betting on the U.S. market or diversifying globally[1].

In this educational guide, we’ll compare the MSCI World vs S&P 500 across key factors – what each index represents, geographic and sector diversification, historical performance, costs, volatility, and accessibility for international investors. By the end, you’ll understand the differences and be able to decide which ETF aligns with your investment goals.

What Do the S&P 500 and MSCI World Index Represent?

S&P 500 Index:

The S&P 500 is a widely-followed index tracking 500 of the largest companies in the United States[2]. These are corporate giants like Apple, Microsoft, Amazon, and others, covering roughly 80% of the U.S. stock market’s value. Because it represents a broad cross-section of the American economy, investing in an S&P 500 ETF means owning a slice of the biggest and most successful U.S. businesses[3]. Historically, the S&P 500 has delivered strong long-term returns (around ~10% annually over decades) while experiencing short-term ups and downs[4]. It’s often seen as the benchmark for U.S. stock market performance.

MSCI World Index:

The MSCI World is a global stock index, designed to give a snapshot of the developed world’s equity markets. It tracks about 1,500 large- and mid-cap stocks across 23 developed countries[5] – including the U.S., Western European nations, Japan, Canada, and more. In fact, it covers roughly 85% of the investable market cap in each of those countries[6]. Unlike the S&P, the MSCI World is not limited to one country; it offers a broader international portfolio. However, note that “World” here means developed markets – emerging economies (like China, India, etc.) are not included in MSCI World. The U.S. still makes up the largest portion of this index (more on that below), but with MSCI World you get exposure to many other economies by buying a single ETF[7]. In summary, the S&P 500 is a pure U.S. play, whereas MSCI World provides global diversification across the major developed markets[8].

Geographic and Sector Diversification

One of the biggest differences between S&P 500 and MSCI World is the diversification across countries and industries.

Geographic Diversification

S&P 500: By design, the S&P 500’s coverage is 100% U.S. companies. All 500 holdings are American firms listed on U.S. exchanges[9]. This means an S&P 500 ETF is essentially a bet on the U.S. economy. If the U.S. market thrives, the fund thrives – but if the U.S. hits a slump, an S&P 500 fund has no direct exposure to offset that with foreign stocks. On the other hand, many S&P 500 companies do business globally; roughly 40% of S&P 500 companies’ revenues actually come from outside the U.S., which provides some indirect international exposure[10]. Still, country risk is largely tied to the United States here.

MSCI World: The MSCI World Index includes companies from 23 different developed countries, so it is far more geographically diversified[11]. In a typical MSCI World ETF, you’ll find holdings from the U.S., Canada, the UK, Germany, France, Japan, Australia, and more. However – importantly – the U.S. still dominates the index due to its large market size. As of mid-2025, about 70% of MSCI World’s weight was in U.S. stocks, with the next largest country weightings being Japan (~5%), the UK (~3-4%), France (~3%), and Canada (~3%)[12]. In other words, MSCI World is global but still U.S.-heavy. You are diversifying across countries, which lowers reliance on any single nation, but the American market remains the biggest component. For example, Japan and European countries collectively form a significant minority of the index, which can help if those markets outperform the U.S. (or cushion the blow if the U.S. underperforms). It’s a broader basket – not a pure U.S. bet.

To visualize the difference: if you invest $100 in an MSCI World ETF, roughly $70 would be in U.S. stocks and $30 in other countries (developed markets like Japan, UK, Europe, etc.)[13]. By contrast, $100 in an S&P 500 fund puts the full $100 into U.S. stocks. This means the MSCI World offers international diversification, though the U.S. still drives a large part of its returns.

Sector Diversification

When it comes to sectors (technology, finance, healthcare, etc.), the S&P 500 and MSCI World look surprisingly similar in composition. Since both indices are weighted by market capitalization and include primarily large-cap companies, they tend to be dominated by the same industries – especially tech.

Technology: Both the S&P 500 and MSCI World have their largest allocation in Information Technology. The exact numbers fluctuate, but currently tech accounts for roughly 25–30% of the S&P 500 and a slightly lower ~20–27% of MSCI World[14][15]. U.S. tech giants like Apple, Microsoft, and Amazon are among the top holdings in both indices. In fact, the top 10 holdings of MSCI World are nearly identical to those of the S&P 500 – companies such as Apple, Microsoft, Amazon, Nvidia, Alphabet (Google), and Meta (Facebook) appear in both[16]. This heavy tech presence has been a big driver of returns in recent years.

Other Sectors: Outside of tech, the sector weights are fairly well distributed in both indices. For example, financials, healthcare, consumer discretionary, industrials, and communications are significant sectors in each. As of July 2025 data, the breakdown was very comparable: after tech, sectors like financials (~14–17%), healthcare (~9–14%), consumer discretionary (~10–11%) each occupy similar proportions in the S&P 500 and MSCI World[17][18]. The differences are minor – e.g., the S&P 500 has a bit more concentration in high-growth U.S. tech and communications companies, whereas MSCI World has a slightly larger share in sectors like financials and industrials due to including banks and manufacturers from Europe/Japan[19][20].

Overall, both indices provide broad sector diversification across most major industries. Neither is concentrated in only one sector (unlike, say, a tech-only fund). The key point is that the S&P 500’s sector exposure is entirely U.S. firms, while MSCI World’s sectors include companies from many countries. But since the largest companies globally tend to be U.S. tech firms, both indices end up holding a lot of the same names at the top. This is why their sector profiles look alike, with Information Technology as the top sector in both[21].

Diversification summary:

MSCI World clearly wins on geographic reach – you get many countries instead of one. This can reduce the impact of any single country’s downturn. However, because the U.S. market is so dominant, MSCI World still has a strong U.S. bias (roughly 2/3 U.S. stocks). Sector-wise, there isn’t a dramatic difference; both give exposure to a wide range of industries, led by tech. If you were hoping MSCI World would be a complete counterweight to U.S. stocks, note that it’s more diversified than S&P 500, but not independent from it. In fact, the two indices are highly correlated – when U.S. markets surge or plunge, global markets often follow in the same direction[22].

Historical Performance Comparison

How have the S&P 500 and MSCI World performed in the past? While past performance doesn’t guarantee future results, looking at historical returns can highlight their differences:

Long-Term (Last ~10–15 years):

The S&P 500 has generally outperformed MSCI World since the 2008–2009 Global Financial Crisis[23]. The 2010s were an especially strong decade for U.S. stocks. Fueled by booming tech giants and a robust U.S. economy, the S&P 500 delivered roughly 13.5% average annual returns in the 2010s, whereas a global index (developed world) returned around 9% per year over the same period[24]. This gap compounded significantly: for example, over 10 years $10,000 in the S&P 500 would have grown much larger than $10,000 in MSCI World. One analysis noted that over 14 years (2009–2023), an MSCI World ETF grew about +426% while the S&P 500 grew about +500% in total[25][26]. The U.S.’s superior performance in that period is largely because American tech companies skyrocketed, and MSCI World’s inclusion of other regions (which had slower growth) dragged its overall returns slightly lower[27].

Shorter-Term or Other Periods:

There have been times when global stocks held up as well as or even better than U.S. stocks. Performance leadership can rotate. For example, in some recent year, the MSCI World actually returned about 18% versus 11% for the S&P 500[28] – showing that international stocks can lead in certain periods (this could happen if U.S. stocks are cooling off while other countries surge). Another scenario was the early 2000s: after the dot-com bubble, the S&P 500 went through a “lost decade” with essentially 0% total return for 10 years (2000–2009), whereas a globally diversified portfolio eked out a small positive return (~0.9% annually for world stocks)[29]. In other words, the 2000s saw international markets slightly outperform the U.S., highlighting that the U.S. dominance of the 2010s was not a given in prior decades.

To illustrate the point, here’s a quick comparison of decade-long annualized returns:

| Period | S&P 500 Annualized Return | Global Stocks Annualized Return (MSCI World or similar) |

|---|---|---|

| 2010–2019 | ~13.5% | ~9.0% (global developed markets) |

| 2000–2009 | ~-0.9% | ~+0.9% (global developed markets) |

The key takeaway is that the S&P 500’s performance has been stellar in recent history, especially with the rise of U.S. tech giants. If you had all your money in U.S. stocks over the last decade, you likely earned higher returns than a globally spread portfolio. However, that trend could change. In the 2020s so far, U.S. stocks remain strong, but no one can predict if the next decade will see a resurgence of other markets. There have been long stretches (like the 1970s or 1980s, not shown above) where international stocks led the way[31].

Both indices suffered major drops during global crises (e.g., both fell sharply in 2008, and both again in early 2020). Because of the high overlap and correlation, in a global downturn they tend to sink together. For instance, when the U.S. market “catches a cold, the rest of the world often sneezes,” as one source put it[28]. During downturns like the 2008 crash or the 2020 pandemic crash, MSCI World and S&P 500 both saw similar drawdowns (over -50% at worst)[32].

Bottom line on performance: The S&P 500 has a track record of higher returns in many periods, thanks largely to U.S. market strength and big tech. MSCI World’s returns have been a bit lower because it includes some slower-growing economies – essentially, global diversification slightly diluted the gains compared to an all-USA portfolio in recent years[33][34]. The flip side is that MSCI World also occasionally outperforms in years when the U.S. is lagging. Long-term investors often see both indices trend upward over time with a high correlation. Neither is immune to bear markets, but both have recovered and grown over multi-decade spans. If you strongly believe the U.S. will continue to outperform, history so far validates the S&P 500 choice. If you’re less sure and want to hedge your bets globally, you might accept a slightly lower return for the benefit of diversification.

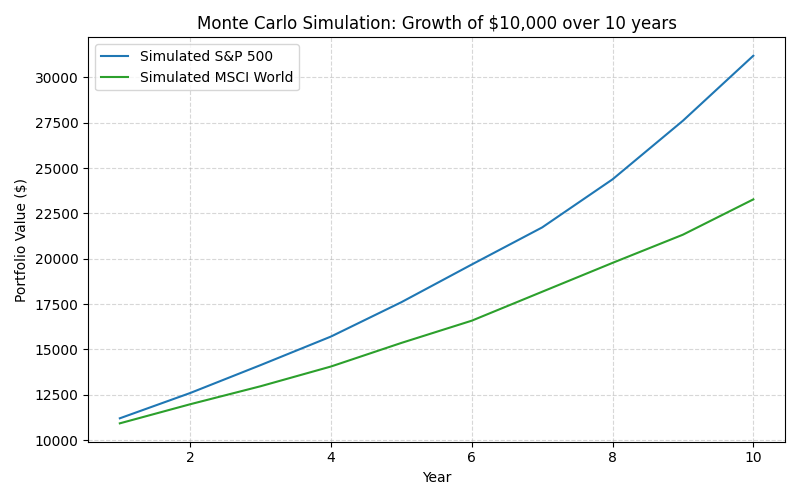

Monte‑Carlo Simulation: Hypothetical 10‑Year Growth

To illustrate how different return profiles impact long‑term growth, a simple Monte‑Carlo simulation was run using hypothetical annual return assumptions. The simulation assumes a $10 000 initial investment, annual returns drawn from a normal distribution with a mean of 12 % and standard deviation of 18 % for the S&P 500 (roughly in line with its long‑term average) and a mean of 9 % with a standard deviation of 15 % for MSCI World. Five hundred simulated paths over ten years were generated. The average growth paths are plotted below.

The simulation is illustrative only and not a forecast. Under these assumptions:

The average final portfolio value after 10 years was about $31 200 for the S&P 500 versus $23 300 for MSCI World, with medians of roughly $28 200 and $21 700 respectively. These figures come from randomised returns and simply reflect that higher expected returns tend to compound faster.

Many individual paths overlapped. In some simulations MSCI World outperformed the S&P 500, demonstrating that short‑term relative performance is unpredictable.

Both distributions displayed considerable spread. Even with diversification across hundreds of stocks, portfolios can finish far above or below the average depending on market conditions.

(Reminder: Past performance is not indicative of future results – the next 10 years could always tell a different story!)

Expense Ratios and Fees

When choosing an ETF, cost matters. Lower fees mean more of your money stays invested. Here’s how S&P 500 vs MSCI World ETFs compare on typical expenses:

S&P 500 ETF Fees:

Because the S&P 500 is such a popular and highly competitive index to track, fees are extremely low. In the U.S., large S&P 500 ETFs like Vanguard’s VOO or SPDR’s SPY have expense ratios in the 0.03% – 0.09% range annually (virtually negligible). In Europe, UCITS S&P 500 ETFs also charge very little – for example, iShares Core S&P 500 UCITS (CSPX) and Vanguard S&P 500 UCITS (VUSA) each have about a 0.07% annual fee (TER)[35]. It’s not uncommon to find S&P 500 funds with fees under 0.1%. This means on a $10,000 investment, a 0.05% fee is only $5 per year. S&P 500 ETFs are among the cheapest equity funds available.

MSCI World ETF Fees:

Global funds have slightly higher costs, but they’re still relatively low. MSCI World ETFs typically charge a bit more because covering multiple markets can increase fund management complexity (and they’re slightly less scaled than S&P funds). Many popular MSCI World ETFs have expense ratios in roughly the 0.15% – 0.30% range. For instance, the iShares Core MSCI World UCITS ETF (ticker SWDA) has about a 0.20% TER[36]. Some alternatives like HSBC MSCI World UCITS are around 0.15%[37], and others may go up to ~0.4-0.5% for certain providers or share classes. In the U.S., a comparable product (e.g. iShares MSCI World ETF, ticker URTH) has an expense ratio near 0.24%. So expect to pay a few basis points more for a global ETF versus an S&P 500 fund. On $10,000, a 0.20% fee is $20/year – still very low in absolute terms, but roughly 2-3x the fee of the cheapest S&P 500 fund.

In short, S&P 500 ETFs generally have the edge on cost due to massive scale and competition – you can invest almost for free. MSCI World ETFs cost slightly more, but fees around 0.15–0.20% are still considered low by industry standards. For most long-term investors, the fee difference (a few hundredths of a percent) is not a deal-breaker given the diversification benefits. Just be aware and choose a low-cost fund if possible. Every dollar in fees is a dollar off your returns, so it pays to compare TERs. Major providers like iShares, Vanguard, and HSBC all offer relatively inexpensive MSCI World funds[38], so stick to those reputable low-fee options.

(Tip: Avoid MSCI World funds with very high fees (~0.5% or more) unless they offer something unique, as there are plenty of cheap choices available. Similarly, essentially all S&P 500 ETFs are cheap, but some niche ones (like leveraged or small providers) could charge more.)

Risk Factors and Volatility

How do the risk profiles of the S&P 500 and MSCI World differ? At first glance, one might assume the global index (MSCI World) is safer because of its broad diversification. Diversification does reduce certain risks, but there are some nuances:

Concentration Risk:

The S&P 500 is more concentrated in one country (USA) and even within the index, the top stocks have significant weight. Just a handful of big tech companies make up a large portion of the S&P 500. This means the index can be heavily influenced by the fortunes of a few companies or one economy. If the U.S. economy enters a recession or if U.S. tech stocks tumble, the S&P 500 would likely feel it more strongly. MSCI World spreads this risk across multiple countries – it’s not all eggs in one basket. For example, MSCI World includes large companies from Europe, Japan, etc., so it mitigates single-country risk to some extent[39]. However, remember that because U.S. stocks are over two-thirds of MSCI World, there is still a high overlap. The MSCI World is diversified geographically, but it’s not a cure-all for concentration risk since it remains closely tied to U.S. market performance[40].

Economic and Political Risk:

With an S&P 500 fund, you’re highly sensitive to U.S. economic conditions, policies, and political events[41]. Changes in U.S. interest rates, elections, or regulations can sway the whole index. MSCI World, on the other hand, spreads exposure across various developed economies, which can be a buffer – weakness in one country might be offset by strength elsewhere[42]. You’re not relying on one economy to do well. That said, in a global recession or a crisis that affects all major markets (like a pandemic or financial crisis), MSCI World will drop right alongside the S&P 500. Global diversification doesn’t guarantee safety in a worldwide downturn[43]. It mainly helps if, say, the U.S. is struggling but Europe or Asia is doing fine (or vice versa).

Currency Risk:

This is an often overlooked factor. S&P 500 investments are nearly all in U.S. dollars. If you’re a U.S. investor, there’s essentially no currency risk in the index itself (though foreign investors in a U.S. fund have USD exposure). MSCI World involves multiple currencies – companies in Japan (yen), Europe (euro, pound, etc.), Canada (CAD), etc. When you hold an MSCI World fund, those international stocks’ values will fluctuate with exchange rates as well as their stock prices. This introduces an extra layer of volatility from currency movements[44]. For example, if the euro or yen weakens against your base currency, it can drag down the USD returns of those holdings (and the opposite is also true). So, a global portfolio has to contend with currency gains/losses, whereas a pure U.S. portfolio is all one currency. Some investors view this as an added risk of global funds, while others see it as part of being globally diversified. Either way, it’s a factor in short-term volatility – MSCI World’s USD returns can swing due to currency shifts, which is less of an issue for the S&P (all USD stocks)[45].

Volatility and Correlation:

Both the S&P 500 and MSCI World are composed of large, stable companies, so they tend to be less volatile than, say, emerging market or small-cap indices. Over the long run, the day-to-day and month-to-month volatility of MSCI World and S&P 500 has been quite comparable. MSCI World might be slightly less volatile purely because of diversification (some bad news in one country could be offset by good news in another), but in practice the difference is small. In fact, the correlation between the two indices is very high (often above 0.95)[46], meaning they move almost in lockstep. When U.S. markets have a big swing, global markets echo it. Historical data suggests the S&P 500 actually had a slightly better risk-adjusted return (Sharpe ratio) than MSCI World – likely because the volatility wasn’t much higher but the returns were higher[47]. From a pure volatility perspective, neither index is immune to major drawdowns (both dropped roughly similarly in 2008, for example), and both tend to recover over time.

“Home Bias” vs Global Risk:

For a U.S. investor, sticking with the S&P 500 avoids some risks (like currency and unfamiliar foreign markets) but increases home-country risk. For a non-U.S. investor, an S&P 500 fund means 100% foreign exposure (which could be seen as risky if their home market does well and they have none of it). MSCI World gives a more balanced global exposure which might feel safer for someone in a smaller market (since it includes a bit of everything). It really depends on perspective. Generally, MSCI World reduces dependence on any single country or region, which can lower your specific risk (like a U.S.-specific crash), whereas S&P 500 is a bet on America’s continued strength.

In summary, MSCI World is considered less concentrated and more diversified, which can lower certain risks (like U.S.-specific downturn risk)[48]. It also means you don’t have to predict which country will excel – you’re invested in all major markets, so you “catch” global growth wherever it happens. The S&P 500, though, has concentration risk (all-in on U.S./large-cap stocks) but has delivered higher returns for that risk in recent times. Both indices will fluctuate with market conditions; expect significant volatility in any stock index investment. A globally diversified index might smooth out very slightly some bumps, but when global markets are highly interconnected, there’s no complete escape from volatility. If you value broad diversification and slightly lower single-country risk, MSCI World has an edge. If you value simplicity and are confident in the U.S. market, the S&P 500 is a strong choice. Just be aware of what risks you’re taking with each (U.S.-centric risk vs. multi-currency/global complexity).

Accessibility and Tax Considerations for International Investors

For a global audience of investors, it’s important to consider how easy it is to buy these ETFs and the tax implications, which can vary by country and ETF domicile.

Availability on Investing Platforms:

The S&P 500 is one of the most widely available indices in the world – you can find S&P 500 index funds or ETFs on virtually any stock exchange or broker platform[49]. Whether you’re in the US, Europe, Asia, or elsewhere, there’s likely an ETF tracking the S&P 500 accessible to you. For example, in the U.S. you have SPY, IVV, VOO, etc.; in Europe you have UCITS ETFs like CSPX or VUSA; in Asia and other regions, some exchanges list their own S&P 500 trackers or you can buy U.S./European listings through an international broker. The MSCI World index, while popular, has fewer ETF options and listings globally[50] and is available but a bit more niche[51]. It’s commonly found on major European exchanges (London, Euronext, Xetra in Germany, etc.) and through global brokers. In the U.S., there are fewer mainstream MSCI World ETFs (investors often use similar “ACWI” or “All-World” funds). Still, products like iShares MSCI World (URTH in the US, SWDA in Europe) are available. If you are investing from outside the U.S., you will typically find more S&P 500 ETF choices than MSCI World choices on your platform. European investors, for instance, can easily buy an S&P 500 UCITS ETF or an MSCI World UCITS ETF, but in some smaller markets you might need an account that gives access to international exchanges to get MSCI World funds. In short, S&P 500 ETFs are ubiquitous, while MSCI World ETFs are available but a bit more niche. Make sure to check that your brokerage offers the specific ETF you want; if not, there may be an equivalent alternative (e.g., a “global developed markets” fund similar to MSCI World).

Taxation Considerations:

Taxes can significantly affect net returns, and they can differ depending on the ETF’s domicile (country of registration) and your own country’s tax laws. Key points to consider:

Dividend Withholding Tax: The S&P 500 companies pay dividends (many MSCI World companies do too). If you buy a U.S.-domiciled ETF (like SPY or VOO, which are based in the U.S.), non-U.S. investors face a 30% U.S. withholding tax on dividends by default[52]. Some countries have a tax treaty with the U.S. that can reduce this to 15%, but it’s still a significant cut of your dividends going to the IRS[53]. For example, if the S&P 500 yields 2% in dividends annually, a non-treaty investor would lose 0.6% (30% of 2%) to U.S. tax each year, and even with a treaty you’d lose 0.3%[54]. MSCI World ETFs are often domiciled in places like Ireland (for UCITS funds). An Ireland-domiciled fund benefits from the U.S.-Ireland tax treaty, so it only suffers 15% withholding on U.S. stock dividends internally, and typically no further withholding for the investor on distribution[55]. In other words, a UCITS MSCI World or S&P 500 ETF can be more tax-efficient for non-U.S. investors – the U.S. withholding is reduced, and if the fund accumulates dividends or if your country has no tax on foreign fund distributions, you could come out ahead. For U.S. investors, U.S.-domiciled ETFs are usually best (they get the full benefit of U.S. dividends with no withholding, and foreign stock dividends may have some withholding but that’s a smaller portion of MSCI World).

Estate Tax: Another quirk – the U.S. imposes estate taxes on non-U.S. persons holding U.S. assets. If a non-American investor holds U.S.-based ETFs (including S&P 500 ETFs like SPY/VOO or even a U.S.-listed MSCI World ETF), and their holdings exceed $60,000, there could be a hefty estate tax (up to 40%) upon their death[56][57]. This is a complicated subject, but it’s a consideration for wealthy international investors. UCITS (European domiciled) ETFs are not subject to U.S. estate tax, which is a big advantage for non-U.S. residents[58]. By using an Ireland or Luxembourg domiciled MSCI World or S&P 500 ETF, you sidestep that U.S. estate tax issue entirely[59].

Accumulating vs Distributing Funds:

Many international investors also prefer accumulating ETFs (which reinvest dividends internally) to avoid getting paid dividends that would be taxed as income. In the U.S., almost all ETFs are distributing (they pay out dividends quarterly). In Europe, UCITS ETFs often have accumulating versions. For example, the iShares Core S&P 500 UCITS has an accumulating variant (ticker CSPX) that reinvests dividends, and the iShares Core MSCI World (SWDA) is accumulating by default. This can be more tax-efficient for investors in countries where reinvested dividends aren’t taxed until you sell, or who simply prefer automatic compounding. It’s an accessibility consideration because U.S. ETFs don’t offer that – but UCITS do[58][59]. Depending on your location and tax situation, choosing the right ETF share class (accumulating vs distributing, U.S. vs non-U.S. domiciled) can make a notable difference.

Regulatory Access:

Investors in the EU/UK have regulations (MiFID II/PRIIPs) that prevent them from buying U.S.-domiciled ETFs that don’t provide certain disclosures (KIIDs). Thus, European investors typically must use UCITS ETFs (which are available for both S&P 500 and MSCI World). On the other hand, U.S. investors cannot easily buy foreign-domiciled funds. So practically, your region might dictate which specific ETF you can access. The good news is, either way there’s an equivalent product: e.g., a European can buy the iShares S&P 500 UCITS (CSPX) instead of VOO, and an American could buy a U.S.-listed iShares MSCI World (URTH) if they wanted global exposure.

In summary, international investors should consider ETF domicile and tax: If you’re outside the U.S., a UCITS MSCI World or S&P 500 ETF can reduce withholding taxes (15% instead of 30% on U.S. dividends) and avoid U.S. estate tax[58][59]. If you’re in the U.S., you’ll stick with U.S. ETFs (and you don’t have to worry about U.S. withholding on domestic funds). Everyone should be mindful of their own country’s taxes on dividends and capital gains – those apply regardless of index. It can be complex, but the main point is that from a pure index perspective, both S&P 500 and MSCI World are accessible globally; just pick the right fund version that suits your locale. When in doubt, consult with a tax professional or refer to resources on ETF taxation for your country.

Which Should You Choose? Use Cases for Different Investors

Both MSCI World and S&P 500 ETFs are excellent core investments for a long-term portfolio, especially for a beginner seeking broad market exposure. You really can’t go terribly wrong with either, and many investors hold one or the other as a cornerstone of their strategy. Ultimately, the choice hinges on your personal investment philosophy, goals, and views. To help decide, consider these use cases and investor profiles:

(One important note: it usually does not make sense to hold both an S&P 500 and an MSCI World ETF at the same time. Their overlap is around 70% (by weight)[60][61], so owning both would be redundant for most of your portfolio – you’d basically double up on U.S. stocks without gaining much extra diversification[62]. It’s generally better to pick one, or if you hold both, adjust weights so that you’re intentionally overweighting one or the other.)

Choose an S&P 500 ETF if you…

Believe in U.S. market dominance: If you expect the U.S. economy and its corporations to continue leading global growth (as they have in recent decades), the S&P 500 lets you capitalize on that conviction[63]. You’re essentially betting that the U.S. will keep its stock market supremacy and deliver superior returns. History has favored this bet in the last 10-15 years.

Are comfortable with a U.S.-only portfolio: An S&P 500 investor should be okay with not being internationally diversified[64][65]. You won’t directly benefit from, say, a boom in European or Asian markets. For example, if another country (China, India, etc.) becomes the next economic powerhouse, the S&P 500 won’t include that – you’d miss those gains[65]. You might plan to invest separately in those markets if desired. But if you’re fine focusing on the U.S. (which still indirectly covers global exposure, since S&P companies operate worldwide), then the S&P 500 is straightforward.

Prefer higher recent returns (with some risk): You acknowledge that in exchange for less diversification, the S&P 500 has delivered slightly higher returns historically. You’re aiming for that extra performance, knowing it comes with concentrated risk. You might also like that S&P 500 ETFs have ultra-low fees and high liquidity, making them very cost-effective and easy to trade.

Are a U.S. resident (or want to avoid currency risk): If you live in the U.S., sticking with a U.S. index like the S&P 500 avoids home bias issues (since it is your home market) and any currency complications. It’s often the default choice for American investors’ stock allocation (sometimes alongside a separate international fund). Even for some non-U.S. investors, if your own country’s market is small or you have a strong tilt to the U.S., you might choose S&P 500 for simplicity and then perhaps add a bit of “ex-US” or emerging markets separately when you’re ready.

Choose an MSCI World ETF if you…

Want broad global diversification in one fund: If you like the idea of a “set it and forget it” worldwide portfolio, MSCI World is attractive[66]. You don’t have to decide which country will do best – you own a piece of all major developed markets. This can give peace of mind that you won’t miss out on growth outside the U.S. If the next Apple or Google comes from Europe or Japan, you’ve got it in your basket. It’s a very comprehensive core holding – many investors use MSCI World as their single equity fund to cover the globe. As one commentator put it, “whatever country emerges as the next US, you are covered” with MSCI World[66].

Value risk spreading and can accept a bit lower return: You prefer to avoid over-concentration, even if it has meant slightly lower returns historically. In essence, you’re willing to trade a bit of potential upside for a smoother global exposure. You acknowledge that MSCI World’s inclusion of slower-growth regions might drag performance (this “over-diversification” led to roughly a 1–2% annual return difference vs S&P recently)[67]. But you find that acceptable for the benefit of not putting all your eggs in the U.S. basket. If the U.S. falters and other countries shine, your choice will pay off. And if the U.S. continues to dominate, you still capture a large chunk of that (since ~60–70% of MSCI World is U.S. anyway, you’re not missing much). Many investors choose global index funds specifically to avoid having to guess the winning region each decade.

Are an international investor looking for one-stop exposure: For those outside the U.S., MSCI World provides an easy way to invest globally, including the U.S. but also your own region and others. You might not want to hold multiple funds (one for U.S., one for Europe, one for Asia, etc.). A single MSCI World ETF gives you simplicity – one fund to rule them all (again, note it excludes emerging markets, but you can add a little emerging markets fund if desired for full world coverage). Additionally, if you’re concerned about U.S. ETF taxation (as discussed earlier), you might lean towards an Ireland-domiciled MSCI World fund which efficiently covers the U.S. and foreign stocks under one roof with favorable tax treatment[68].

Plan to invest and “relax”: If you don’t want to frequently rebalance or worry about switching investments, MSCI World auto-adjusts to global market weights. For example, if in the future some country grows significantly in market cap, MSCI World will naturally include more of it. With the S&P 500, you’d have to actively decide to invest outside the U.S. if circumstances change[68]. MSCI World is more of a “hands-off” all-in-one approach suitable for a truly passive investor.

Finally, it’s worth emphasizing that both options are solid choices for long-term investors. There is no clear-cut “better” index – it really depends on your perspective and goals[69]. The S&P 500 and MSCI World are highly correlated and share many of the same top companies, so either will give you exposure to global corporate giants and growth over time. If in doubt, many advisors lean toward global diversification for beginners – an MSCI World ETF ensures you have a bit of every major market, which can be reassuring. On the other hand, the U.S. market’s historical strength and innovation make the S&P 500 a compelling core holding, especially if low cost and simplicity are priorities.

Conclusion

Assess your own convictions and needs. If you’re confident that “America First” will continue in markets and want the slightly higher risk/reward, an S&P 500 ETF might suit you best. If you prefer not to gamble on one country and want broad coverage, go with a MSCI World ETF for a globally diversified portfolio. Either way, stick to low-cost ETFs, invest consistently, and think long-term. Both indices have served investors well and can be excellent vehicles to grow your wealth over decades. By understanding the differences outlined above – in diversification, performance, fees, and risks – you can make an informed choice that you’ll feel comfortable with as a beginner investor venturing into the world of ETFs.

Frequently Asked Questions (FAQ)

Quick answers to the most common reader questions about MSCI World vs S&P 500. For definitions and deeper context, see the sections above. Back to top ↑

Is the MSCI World more diversified than the S&P 500?

Yes—MSCI World spans ~23 developed markets, while the S&P 500 is U.S.-only. However, MSCI World still has a large U.S. weight (roughly two-thirds), so both remain heavily influenced by U.S. performance. See diversification.

Which historically performed better?

Since the Global Financial Crisis, the S&P 500 generally outperformed, largely due to U.S. mega-cap tech strength. Leadership can rotate by decade, though. See historical performance.

Should beginners hold both MSCI World and S&P 500?

Usually no. Overlap is high (~70% by weight), so holding both often just doubles U.S. exposure. Pick one core, then add targeted tilts (e.g., ex-US or emerging markets) if needed. See use cases.

What’s the fee difference?

S&P 500 ETFs are typically ultra-low cost (~0.03–0.09% in the U.S.; ~0.07% UCITS). MSCI World funds are low but a bit higher (~0.15–0.30%). See fees.

How do taxes differ for international investors?

ETF domicile matters. Many non-U.S. investors prefer Ireland-domiciled UCITS funds (S&P 500 or MSCI World) for treaty-reduced U.S. dividend withholding and avoiding U.S. estate tax. See access & tax.

What about currency risk?

S&P 500 is USD-only; MSCI World adds multiple currencies (EUR, JPY, GBP, etc.), which can add short-term volatility in your base currency. See currency risk.

Is MSCI World safer because it’s global?

It reduces single-country risk but remains highly correlated with the U.S. market. In global sell-offs, both tend to drop together. See volatility & correlation.

Does MSCI World include emerging markets?

No. MSCI World covers developed markets only. To include emerging markets, add a dedicated EM fund or use an “All-World” index instead. See index scope.

Which is better for “set-it-and-forget-it” investing?

MSCI World offers one-fund global coverage that auto-adjusts with market weights. S&P 500 is simpler but U.S.-only—some investors pair it with a separate international fund. See which to choose.

Accumulating vs distributing: what should I pick?

Outside the U.S., accumulating UCITS share classes (e.g., CSPX/SWDA) reinvest dividends automatically and can be tax-efficient depending on local rules. U.S. ETFs typically distribute. See accumulating vs distributing.

Can MSCI World outperform the S&P 500?

Yes—there are multi-year periods where ex-U.S. markets lead. If non-U.S. regions rebound or the U.S. underperforms, MSCI World can come out ahead. See shorter-term periods.

What position sizing makes sense?

Common approaches: 100% in a single core (S&P 500 or MSCI World), or a split such as 60–80% core + 20–40% tilts (e.g., EM, small-cap). Align with risk tolerance, timeline, and home-country exposure. See risk.

How do sector weights compare?

Both are large-cap, market-cap-weighted and tech-heavy at the top (Apple, Microsoft, etc.), so sector profiles look similar—main difference is geographic breadth. See sector diversification.

What if I already own lots of U.S. stocks?

MSCI World can help diversify beyond the U.S. If you’re already U.S.-heavy (individual stocks or RSUs), a global core may balance country risk. See geographic diversification.

Sources & Further Reading

- fncapital.io

- fifthperson.com

- fifthperson.com

- fifthperson.com

- fncapital.io

- fncapital.io

- investingintheweb.com

- investingintheweb.com

- investingintheweb.com

- investingintheweb.com

- investingintheweb.com

- investingintheweb.com

- moneykingnz.com

- investingintheweb.com

- moneykingnz.com

- stoicmoneycoach.com

- investingintheweb.com

- moneykingnz.com

- vestinda.com

- vestinda.com

- investingintheweb.com

- investingintheweb.com

- investingintheweb.com

- moneykingnz.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- fncapital.io

- moneykingnz.com

- stoicmoneycoach.com

- moneykingnz.com

- reddit.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- investingintheweb.com

- investingintheweb.com

- investingintheweb.com

- investingintheweb.com

- vestinda.com

- fncapital.io

- vestinda.com

- vestinda.com

- fncapital.io

- vestinda.com

- fncapital.io

- investingintheweb.com

- fncapital.io

- fncapital.io

- investingintheweb.com

- investingintheweb.com

- investingintheweb.com

- fifthperson.com

- fifthperson.com

- fifthperson.com

- fifthperson.com

- fifthperson.com

- fifthperson.com

- fifthperson.com

- fifthperson.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- investingintheweb.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- stoicmoneycoach.com

- investingintheweb.com