How to Find Deep Value Stocks: A Beginner’s Guide to Undervalued Investing

9/6/2025

How to Find Deep Value Stocks: A Beginner’s Guide to Undervalued Investing

Introduction: Investing in stocks can feel overwhelming for newcomers. One strategy that has stood the test of time is value investing – specifically looking for deep value stocks. These are stocks trading at significant discounts to their intrinsic worth, often due to market overreactions or being overlooked. In simple terms, you’re hunting for undervalued companies whose share prices are lower than what their fundamentals justify. This beginner-friendly guide will explain what deep value stocks are, why they can be attractive investments, and how to invest in value stocks by finding these hidden gems. We’ll focus on the U.S. stock market, use real company examples, and break down key steps and metrics so stock market investing for beginners becomes less intimidating. By the end, you’ll know how to spot potential bargains in the market, avoid common pitfalls (like “value traps”), and take action on your investing journey. Let’s dive in!

What Are Deep Value Stocks?

Deep value stocks are shares of companies that appear extremely undervalued relative to their true worth. In other words, their stock price is far below the intrinsic value of the business’s assets, earnings, and long-term prospects . This gap between price and value is what value investors aim to exploit – buying a dollar’s worth of assets for 50 cents, as the saying goes. Several factors can cause a stock to become deeply undervalued: market overreactions to bad news, industry-wide downturns, or lack of Wall Street attention (often the case with smaller companies) . For example, a company might hit a temporary setback – a bad earnings quarter or a scandal – causing its stock to plummet. If the core business remains strong, the sell-off could be an opportunity for bargain hunters. Legendary investor Warren Buffett built much of his fortune this way, by identifying businesses trading below their intrinsic worth and patiently waiting for the market to catch up . The key principle is the distinction between price and value. As Buffett famously said, "Price is what you pay; value is what you get." A stock’s price is just what people are willing to pay today – it swings with market sentiment, news, and emotions. Value is what the company is actually worth based on its fundamentals (assets, earnings power, growth prospects) . Deep value investing means finding cases where value far exceeds price, then buying in and holding until the rest of the market realizes the mismatch. It’s the essence of "buy low, sell high."

Why Invest in Deep Value Stocks?

For patient investors, deep value stocks can offer attractive long-term returns. Historically, value stocks as a category have outperformed growth stocks and the broader market over extended periods . In fact, over nearly a century (since 1927), value stocks have beaten growth stocks by an average of about 4% annually . The idea is that buying solid companies at discounted prices stacks the odds in your favor – you have a built-in "margin of safety" in case your analysis isn’t perfect . Value investing works because markets are not perfectly efficient. Emotions like fear and greed can drive prices to extremes. A stock might get oversold on pessimism, making it ripe for a rebound once calm returns. For example, during broad market crashes or recessions, even quality U.S. companies have seen their shares trade at fire-sale prices due to short-term panic. Those who bought such undervalued companies and held on often enjoyed strong gains when the market recovered. Another benefit: deep value stocks are often established businesses with stable finances. They might pay dividends (value stocks often have higher dividend yields on average ) and tend to be less volatile than hot growth stocks. This can make them suitable for beginners who prefer a bit more stability. Many deep value companies also operate in boring or out-of-favor industries – think manufacturers, banks, or consumer goods – which means you’re not chasing trendy, speculative bets but rather betting on solid fundamentals. Of course, patience is required. Undervalued stocks may stay undervalued for months or even years before the market recognizes their true worth . But legendary value investors like Benjamin Graham and Warren Buffett assure us that "in the short run the market is a voting machine, but in the long run it’s a weighing machine." Over time, a company’s real value tends to be reflected in its stock price. Deep value investing appeals to those willing to be contrarian and wait for that payday.

Key Metrics to Identify Undervalued Companies

So, how do you actually spot a deep value stock? Successful value investors use fundamental analysis – digging into a company’s financial metrics – to gauge if a stock is cheap or expensive relative to its true value. Here are some key metrics and indicators that help identify undervalued companies:

Price-to-Earnings (P/E) Ratio

The P/E ratio is the stock price divided by annual earnings per share. A low P/E (especially compared to the broader market or industry peers) can signal a bargain. For instance, if most companies in an industry trade at ~15× earnings and one solid company trades at 8× earnings, it might be undervalued . Context is critical, though – a very low P/E could also mean the company has underlying problems . Make sure to compare a stock’s P/E to its own historical range and sector average.

Price-to-Book (P/B) Ratio

P/B compares the stock price to the book value (assets minus liabilities per share). A P/B below 1.0 means you’re paying less than the accounting value of the company’s assets – essentially buying assets for pennies on the dollar . This potentially indicates deep value, particularly for banks and other asset-heavy businesses . However, check why P/B is low: it could reflect expected asset write-downs or poor profitability . Many classic value investors look for P/B ratios under ~1.5 alongside other positive signs .

Price-to-Sales (P/S) Ratio

For companies with temporarily low earnings (or startups not yet profitable), P/S looks at price relative to revenue. A low P/S (especially <1.0) can highlight companies valued at less than their annual sales . This can be useful for spotting turnarounds or early-stage firms – though again, compare to peers and consider profit margins.

PEG Ratio (Price/Earnings-to-Growth)

The PEG ratio divides the P/E by the company’s earnings growth rate. A PEG below 1.0 is a classic sign of a potential undervalued growth stock – it suggests the stock’s price is low relative to its expected growth . For example, a company with a P/E of 10 and expected growth of 15% has a PEG of ~0.67, which is attractive. PEG helps you avoid cheap stocks that are cheap because they have no growth.

Dividend Yield

Many value stocks pay dividends. Dividend yield = annual dividend / share price. If a company’s dividend yield is significantly above its historical average or higher than peers, the stock might be underpriced . But be cautious: an extremely high yield (e.g. >8%) can be a warning sign that the market expects a dividend cut (the stock price may be down for a good reason). Focus on companies with sustainable dividends and moderate payout ratios.

Debt Levels (D/E Ratio and Current Ratio)

A company might look cheap based on price metrics, but you must check its financial health. The debt-to-equity (D/E) ratio compares total liabilities to shareholders’ equity – high debt can make a “cheap” stock very risky. Likewise, the current ratio (current assets / current liabilities) indicates short-term financial strength; a ratio above 1.5 suggests healthy liquidity . In value investing, strong balance sheets give confidence that a company can weather tough times. Aim for manageable debt (D/E below industry averages) and adequate liquidity .

Free Cash Flow

Free cash flow (FCF) is the cash a company generates after capital expenses. A company consistently producing positive FCF is generally in a stronger position. Some deep value investors look at free cash flow yield (FCF per share / price) as a measure of value – if it’s higher than alternative investments (like bonds) or the market average, the stock might be undervalued. High FCF means the firm could pay down debt, buy back stock, or survive a downturn, making it more likely that value will eventually be realized.

These metrics are starting points. A truly deep value stock often scores well on multiple measures – for example, low P/E and low P/B and high dividend yield. Always use a combination of metrics to get a fuller picture . No single ratio tells the whole story, but together they can signal whether a stock is worth further investigation.

How to Find Deep Value Stocks (Step-by-Step)

Identifying a potential deep value opportunity involves a mix of screening for ideas and digging deeper into each candidate. Here’s a step-by-step approach to finding and evaluating deep value stocks:

Screen the Market for Bargains

Modern value hunting works best when you let tools sift the noise first: run systematic scans, rank by valuation and balance-sheet strength, then sanity-check the shortlist with price action, quality, and cash-flow metrics. Automating this loop daily keeps your radar fresh without chaining you to a spreadsheet. If you want a quiet edge, Finance Halo’s AI agent already screens the entire market every morning and drops explainable deep-value ideas into your feed—open today’s list, tweak the preset to your style, and save it for tomorrow’s run.

Do a Quick Qualitative Check

Before diving into financial statements, do a common-sense check on each candidate. Why might this stock be undervalued? Is the company facing some controversy, or is the whole industry struggling? Sometimes a low valuation is justified (for example, a dying business model). You’re looking for situations where the issues are temporary or fixable – maybe a strong brand that hit a bump, or a solid company in an out-of-favor sector. Reading recent news and analyst commentary can provide context.

Analyze Financial Statements

Now, roll up your sleeves and examine the company’s fundamentals. Look at the balance sheet for assets and debts – is the company solvent and not overloaded with debt? Check the income statement for trends in revenue and earnings (consistent profits or growth signal stability). And don’t forget the cash flow statement – positive free cash flow is a great sign of underlying health . Ensure that any “cheap” valuation metrics aren’t masking deteriorating fundamentals like falling sales or thinning profit margins . This step separates true bargains from value traps (stocks that are cheap for good reason). For example, if a company’s earnings have declined each year for 5 years, a low P/E might be a trap, not an opportunity .

Assess Competitive Advantages

A deep value stock is even more compelling if the company has a durable competitive advantage, or economic moat. Does it have a strong brand, exclusive assets, patented technology, or a captive customer base? Companies with moats can rebound faster and keep competitors at bay . For instance, a consumer products company with beloved brand names might be a safer bet than an unknown commodity business, even if both appear undervalued. Warren Buffett evolved from buying any cheap stock (“cigar butt” investing) to favoring quality businesses at fair prices. As a beginner, try to target undervalued stocks that are also fundamentally good businesses.

Estimate Intrinsic Value

To truly know if a stock is deeply undervalued, you’ll want an estimate of its intrinsic value (what the company is really worth per share). You don’t need a fancy model; even a rough method helps. One simple approach is using earnings and growth estimates. Benjamin Graham, the father of value investing, proposed a formula for intrinsic value: Value = EPS × (8.5 + 2g), where g is the expected growth rate . You can also look at average valuation multiples for the company over the past decade or compare it to peers. Another quick gauge: if the stock were to trade at a reasonable P/E (say the market average ~15), what would the price be? Compare that to the current price. These methods give ballpark figures to see if a stock is, say, 30% or 50% undervalued. Remember to be conservative in assumptions – it’s better to underestimate value than overestimate.

Ensure a Margin of Safety

A core concept in value investing is the margin of safety – only buying a stock if it’s significantly below your estimated intrinsic value . This buffer protects you in case your analysis is off or the company hits a surprise problem. For example, if you calculate a stock is worth $100 per share, you might wait to buy until it’s $70 (a 30% discount to value). Graham often suggested demanding a 25–50% discount for a comfortable margin of safety . The more uncertain the business (risky industry, fluctuating earnings), the bigger discount you should seek. Practically, this might mean setting a target buy price and being patient for the stock to hit it.

Diversify and Be Patient

Even with careful analysis, not every deep value pick will pan out. Some stocks may stay cheap for years or suffer permanent declines. That’s why it’s wise to diversify your investments across multiple value stocks and industries. Don’t put all your money in one “too-good-to-be-true” stock. By holding a basket of undervalued stocks (say 10-20 or more), the winners can outweigh the losers . Once you’ve bought, be prepared to hold for the long term – often 3-5 years – for the value to be realized . It can test your patience, but many deep value investors are rewarded when a company’s fortunes improve or a catalyst (like a buyout or new product) unlocks the stock’s value.

Following these steps, you’ll gradually build confidence in how to invest in value stocks. Start small – perhaps analyze a company you already know as practice. Over time, you’ll sharpen your ability to tell apart a true bargain from a value trap.

Examples of Deep Value Investing in Action

Let’s look at a few real-world examples involving U.S. companies, which illustrate the deep value approach:

American Express (AXP) in the 1960s

In 1963, American Express was embroiled in the infamous “Salad Oil Scandal,” which caused its stock price to crash. Despite the panic, the core business was strong. Sensing an opportunity, a young Warren Buffett bought a 5% stake in AmEx amid the scandal fallout . This contrarian bet paid off handsomely as confidence returned and the stock recovered. The episode became one of Buffett’s early successes and a classic example of buying a great company facing a temporary crisis.

Bank of America (BAC) after the 2008–09 Crisis

In the years following the financial crisis, big banks were out of favor. In 2011, Bank of America’s stock was trading at roughly a 62% discount to its book value (i.e. price far below the company’s net asset value) . This indicated extreme pessimism. Investors who believed BofA would pull through (notably Buffett, who invested $5 billion in BofA preferred stock around 2011) saw tremendous upside as the bank stabilized and its stock price eventually climbed. The lesson: during periods of fear, solid companies can trade at deep discounts, offering brave investors a bargain.

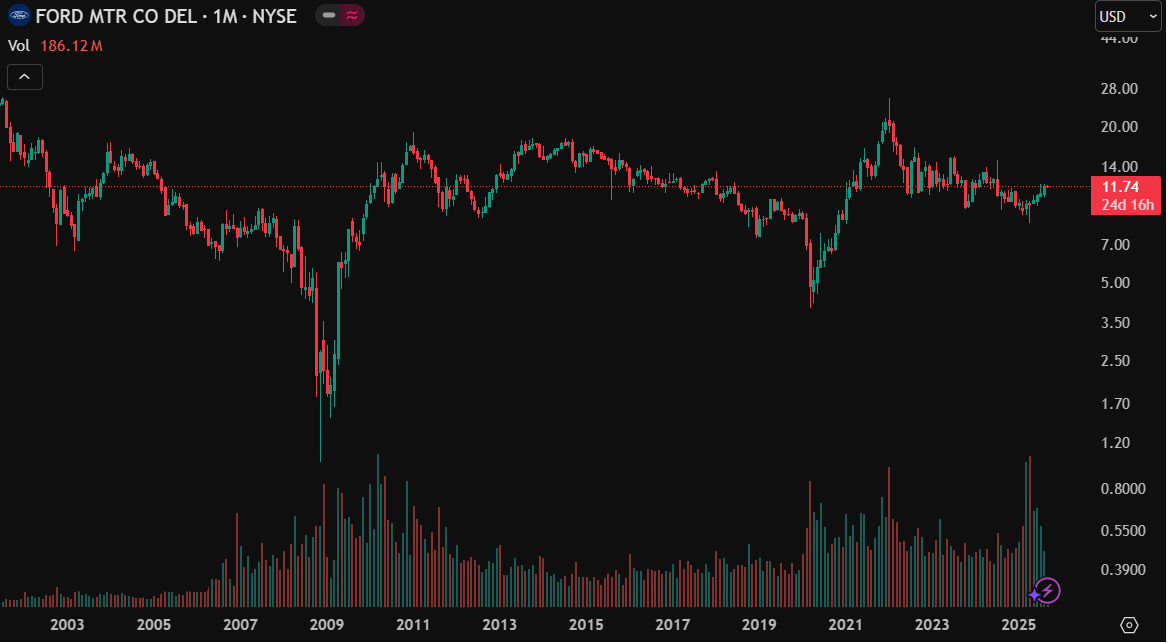

Ford (F) during the 2008 Recession

The auto industry was hit hard in the 2008 recession. Ford’s stock price plunged from around $8 in 2007 to under $1 by late 2008 , reflecting investors’ fear that the company might go bankrupt (as two of its U.S. rivals did). However, Ford avoided bankruptcy and emerged stronger in the recovery. Those who bought Ford shares near the bottom essentially purchased an iconic American company for literal pennies – and were rewarded as the stock eventually rebounded. This case shows how deep value opportunities often appear when market sentiment is worst, though it also underlines the importance of assessing bankruptcy risk before jumping in.

Each scenario above involved a company that was undervalued due to extraordinary circumstances: a scandal, an economic crisis, an industry downturn. Deep value investors look for these kinds of situations – where emotion and fear drive prices well below reasonable valuations. By studying these examples, beginners can see the importance of courage, thorough research, and conviction in value investing. (Note: Hindsight makes it look easy; in real time, these were not “sure things” – which is why the stocks were so cheap!)

Avoiding Value Traps and Other Tips for Beginners

While hunting for deep value stocks, it’s crucial to tread carefully. Not every low-priced stock is a good deal – some are cheap for fundamental reasons and may never recover. Here are some tips to help you avoid pitfalls and improve your success as a beginner value investor:

Beware of Value Traps

A value trap is a stock that looks undervalued but isn’t actually a good investment because the business is deteriorating. Signs of a potential value trap include declining revenues or earnings year after year, chronically unprofitable operations, or outdated business models . For example, a retailer with plunging sales might trade at a low P/E, but if its customers are moving online (and it fails to adapt), the company’s value could keep eroding. Always investigate the business trends behind the numbers. If the fundamentals are worsening with no clear turnaround plan, think twice.

Diversify Your Portfolio

As mentioned, don’t concentrate all your money in one stock or one sector. Deep value investing often involves some companies that are down on their luck – and not all will bounce back. By holding a diverse mix of 10, 20, or more value stocks, you increase the odds that a few big winners make your overall strategy profitable . Diversification also reduces the impact if one holding blows up. In the U.S. market, you can find value candidates across industries – from finance to industrials to tech – so spread out to manage risk.

Do Your Homework (Fundamental Analysis)

It bears repeating: thorough research is your best friend. Read financial statements, annual reports (10-Ks), quarterly earnings calls – whatever information you can get. The more you understand a company, the better you can estimate its intrinsic value and identify any red flags. Pay attention to things like debt maturities (will a heap of debt come due soon?), profit margins, and cash flow. If accounting isn’t your strong suit, start with a basic investing book or online course to learn how to analyze companies. Value investing is as much about analytical work as it is about the buying and selling.

Patience, Patience, Patience

Deep value stocks often require time to play out. After you buy, the stock might even fall further before it rises. It can be hard to sit tight when others are chasing the next hot trend. But remember the ethos of value investing – you’re in it for the long haul. If you’ve done your research and the company’s fundamentals remain intact, try not to let short-term price fluctuations shake you out of your position. As long as the investment thesis is still valid, patience can allow the stock’s value to be realized. Many famous value investors attribute much of their success to staying the course.

Use a Margin of Safety

As discussed earlier, insist on a margin of safety in your purchase price. This discipline will automatically filter out many marginal ideas and protect you from overpaying. It also helps set your mindset: if a stock you like is not yet cheap enough, stay on the sidelines until it is. It’s okay to miss a few opportunities; what you want to avoid is paying too much for a stock that seemed “kinda” cheap and then goes down further. Sticking to your target buy price (derived from conservative assumptions) is a great habit for beginners to develop.

Keep Emotions in Check

Value investing often means going against the crowd. You might buy stocks that everyone else hates at the moment. This can be emotionally challenging – it’s human nature to seek comfort in popular opinion. To succeed, try to cultivate a contrarian mindset and don’t rely on the market’s mood for validation. If you’ve done your analysis and determined a stock is deeply undervalued, be confident in your reasoning. Conversely, be ready to cut your losses if new information shows your analysis was wrong. Always be flexible and rational rather than stubborn.

Continuous Learning

Finally, treat each investment as a learning experience. When a deep value play works out, analyze what went right (Was your valuation on target? Did a catalyst emerge?). If it doesn’t work out, examine what you missed. Maybe the industry landscape changed or management made poor decisions – use it to refine your approach next time. Read books by value investing gurus (like The Intelligent Investor by Benjamin Graham) and consider following letters from renowned investors (Buffett’s annual letters are a treasure trove of wisdom). Over time, your skill at spotting true value will improve.

As a beginner, you might also benefit from learning broader investing basics alongside value strategy. (For instance, check out our guide on stock market investing for beginners to solidify your foundation.) Value investing doesn’t operate in a vacuum – understanding market cycles, interest rates, and diversification will complement your stock-picking skills.

Conclusion and Next Steps

Finding deep value stocks is like searching for diamonds in the rough – it requires patience, research, and a bit of courage to go against the crowd. By focusing on fundamental metrics, looking for quality businesses trading at discounts, and demanding a margin of safety, even beginner investors can learn to identify undervalued companies in the U.S. stock market. We’ve covered how to spot opportunities using P/E, P/B and other ratios, how to research a company’s financial health, and steps to build a diversified, value-focused portfolio. Remember the key lessons: do your homework, stay patient, and don’t be afraid to zig when others zag (provided you’ve got the data on your side). Now it’s time to put this knowledge into action. Call to Action: Consider applying these principles to your own investing journey today. You might start by picking a well-known company and analyzing its valuation, or using a stock screener to find a few potential deep value candidates. Open a practice account or create a watchlist to track stocks you think are undervalued. As you gain confidence, you can begin investing real money prudently in some of these ideas (always only what you can afford, and preferably as part of a broader balanced portfolio). Deep value investing is a rewarding strategy for those willing to think long-term and dig into the facts. With the tools and tips from this guide, you’re better equipped to find those hidden gems in the stock market. Happy investing – may your patience and diligence pay off as you uncover the next great bargain!